Gold Has long been considered a safe for investor, and in today’s uncertain economic climate, keeping an eye on the gold price in the U.S. has never been more important. Whether you’re a seasoned investor or simply curious about the value of this precious metal, understanding them can help you make smarter financial decisions.

current cold price in the U.S.

As of today, the gold price in the U.S. stand at $3,886.84 USD per ounce. Prices fluctuate daily due to global economic conditions, currency strength, and market demand. Many investors track these changes closely, as even small shift can impact investment portfolions, retirement funds, or commodity trading decisions.

What Drives Gold Prices?

- U.S. Dollar Strenght

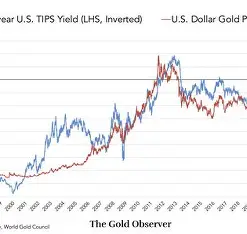

Gold and the U.S. dollar share an inverse relationship. when the dollar strengthens, gold often becomes more expensive for foreign buyers, which can boost gold prices as international buyers find it cheaper to purchase. - Inflation concerns

GOLD is traditionally seen as a hedge against inflation. rises, the purchasing power of currency declines, making tangible assets like gold more attractive. Recent trends in U.S. inflation rates have fueled interest in gold as a safe investment. - Federal Reserve policies

Interest rate decisions by the Federal Reserve impact gold prices indirectly. Higher interest rates can make fixed income investments more attractive, reducing gold demand, while lower rates tend to increase interest in gold. - Global Economic Uncertainty

Events such as geopolitical tensions, stock market volatility, or global recessions often drive investors toward gold. Its stability in uncertain times reinforces its reputation as a “safe haven” asset.

Historical Perspective

Looking back over the past five years, gold has seen a steady upward trend, particularly during periods of economic uncertainty. For instance, during the pandemic in 2020, gold prices spiked as investors sought stability amidst market turmoil. Understanding historical trends helps investors anticipate potential movements in the current market.

Gold vs. Other Investments

Many investors compare gold with stocks, bonds, or cryptocurrencies. Unlike stocks, gold does not generate dividends, but it provides security and liquidity. Compared to cryptocurrencies, gold is less volatile, making it a preferred choice for conservative investors. Its ability to preserve wealth over time continues to make it a cornerstone of diversified investment strategies.

Tips for Following Gold Prices

Track Real-Time Prices: Websites and apps provide live gold price updates in USD per ounce.

Monitor Economic News: Federal Reserve announcements, inflation data, and global events can influence prices.

Diversify Investments: Consider balancing gold with other assets to reduce risk.

Final Thoughts

Keeping an eye on the gold price in the US can help you make informed investment decisions. Whether you’re buying gold coins, ETFs, or investing indirectly through funds, understanding the trends and factors that drive the market is essential. Gold remains a reliable choice for preserving wealth, hedging against inflation, and navigating uncertain economic times.

FAQs

What is the current gold price in the US?

Gold prices fluctuate daily. As of today, it stands at [insert current price] USD per ounce.

Why does the US dollar affect gold prices?

Gold and the dollar usually move in opposite directions. A stronger dollar can reduce gold demand, lowering prices, while a weaker dollar often boosts gold prices.

Is gold a good investment in 2025?

Gold is considered a safe haven and a hedge against inflation. It can be a valuable addition to a diversified investment portfolio.

How can I track gold prices?

You can track gold prices through financial news websites, trading apps, and live market charts updated in real-time.