Introduction

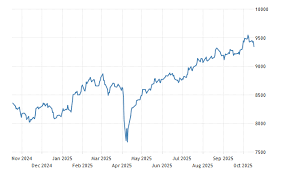

The UK Stock Market 2025 stands at a critical turning point. with global economic pressures, political policy changes, and rising investment in Ai and green energy, the FTSE 100 and FTSE 250 are showing mixed signals. while inflation and fiscal tightening have worried investors, optimism around technology, energy reform, and infrastructure growth has sparked renewed market confidence.

In this artical, we break down the latest U.K. stock market news, analyze the key trends, identify risk and opportunities, and spotlight the top five stocks to watch this quarter.

What’s Going On: Key Recent Developments.?

- Government Borrowing Costs Drop

The Yield on U.K. 10-year gilts recently fell below 4.5%, its lowest since July 2025. This signals easing borrowing costs and rising investor demand for U.K. bonds – a good sign for stability. However, it also reflects investor caution as global uncerainties persist. - Fiscal Policy and Tax Signals

Chancellor Rachel Reeves has hinted at possible tax rises for high earners and cuts in public spending. with a potential £22 billion fiscal gap, the government and responsibility. These measures could impact investor sentiment and corporate earnings. - Inflation and Interest rates

Inflation remain sticky, though it has slowed compared to early 2025. Markets are pricing in a possible Bank of England rate cut by mid-2026 if economic data continues to cool. Lower rates could boost stocks and housing, but too-early cuts might reignite inflationary pressure. - Banking Sector Weakness

Concerns about U.S. regional banks and bad loans have rippled though the U.K. financial sector. Major lenders like Barclays, HSBC, and NatWest have faced share price volatility. investors are watching closely for regulatory responses and loan-loss data. - Tech and AI Surge

Britain’s tech sector is thriving. AI-driven firms like Nscale recently landed a $14 billion Microsoft Partnership, positioning the u.k. as European leaderin digital infrastructure. This momentum is fueling Optimism in tech and data-centre investments. - Energy Market shifts

The energy industry faces mounting consumer debt (around £4.4 billion). Companies like Iberdrola – the parent of Scottish Power – are exploring strategic divestments as competition heats up with players such as Octopus Energy and British Gas.

What It Means for Investors

| Impact Area | Investor Takeaway |

| Interest Rates | Falling yields may attract investors back to equities, particularly growth and dividend stocks. Watch BoE’s next move carefully. |

| Fiscal Policy | Higher taxes or budget tightening can pressure margins for UK corporates. Diversify across sectors to manage exposure. |

| Banking Sector | Volatility likely to persist. Short-term risk, but potential long-term value once global credit stress stabilises. |

| Tech/AI Growth | Strong upside for companies in data, automation, and green AI infrastructure. Long-term growth trend. |

| Energy & Utilities | Tight margins and regulatory scrutiny may limit profits, but green transition projects offer medium-term opportunities. |

Loopholes & Risks to watch

Even with positive signals, certain risks could derail market optimism:

- Over-valuation in AI and tech stocks – valuation are stretched; earnings may not yet justify prices.

- Policy unpredictability – sudden tax changes or new regulations could push inflation higher again.

- Inflation shock risk – global energy or food price spikes could push inflation higher again.

- Currency volatility – a weaker pound could boost exports but raise import costs, impacting inflation.

- U.S. and global spillover effects – instability in U.S. banking or trade tensions could hit global sentiment.

Top 5 U.K. Stocks to watch in late 2025

- BP Plc (BP.L)

With oil prices stabilizing and a stronger focus on renewable energy, BP remains a key energy transition stock. Its hybrid strategy – balancingnfossil fuels and green projects – appeals to both value and sustainability investors. - Barclays Plc (BARC.L)

Despite short-term volatility, Barclays has maintained strong capital reserves. If the banking sector stabilises globally, the stock could rebound significantly in 2026. - Nscale Technologies (Private, IPO Expected 2026)

The UK’s rising AI data-centre firm is expected to be one of Europe’s biggest tech listings. Its recent $14 billion Microsoft partnership highlights huge growth potential in the AI infrastructure sector. - GlaxoSmithKline (GSK.L)

A consistent performer with a solid dividend yield. GSK’s expansion in vaccines and AI-based drug discovery keeps it a strong defensive play amid market volatility. - National Grid (NG.L)

As the UK accelerates toward net-zero targets, National Grid’s infrastructure projects make it a reliable long-term investment for dividend seekers and ESG investors alike.

What Could Happen Next: Market Scenarios

- Stable Growth Scenario

If inflation continues to cool and the government’s fiscal plans remain credible, the FTSE 100 could see steady gains. Tech, infrastructure, and healthcare sectors may outperform. - Stress Scenario

Renewed inflation or a global banking shock could hit financial stocks hard. Defensive investments such as utilities, healthcare, and gold may outperform. - Bullish Breakout Scenario

Improved trade relations, steady global growth, and investor optimism in UK innovation could trigger a strong rally, pushing major indices to new highs by 2026.

Conclusion

The UK stock market 2025 offers a blend of challenges and opportunities. Falling government borrowing costs and the surge in AI investment give reasons for optimism, while inflation and fiscal policy uncertainty continue to test investor patience.

For those willing to navigate volatility, diversification is key — focusing on a mix of stable dividend stocks, AI-driven tech players, and infrastructure firms aligned with the UK’s sustainability goals.

Smart investors will keep one eye on inflation data and the other on policy signals from the Bank of England. With patience, timing, and balanced risk management, 2025 could still be a rewarding year for UK market participants.

FAQs

What is the current trend in the UK stock market in 2025?

The UK stock market in 2025 is experiencing mixed trends — with easing inflation, falling bond yields, and renewed interest in AI and green energy. However, uncertainty around government fiscal policy and global trade tensions is keeping volatility high.

Which sectors are performing best in the UK stock market right now?

Technology, AI infrastructure, and renewable energy sectors are showing strong growth. Meanwhile, financials and consumer stocks remain cautious due to inflation and credit concerns.

Is it a good time to invest in UK stocks in 2025?

Yes, but selectively. Investors should focus on sectors with long-term potential like tech, healthcare, and infrastructure while avoiding over-leveraged or highly regulated sectors. Diversification is crucial given the ongoing policy and inflation risks.

How is the Bank of England affecting the UK stock market?

The Bank of England’s stance on interest rates plays a major role. If rates ease in 2026 as expected, it could boost equity prices, especially for growth and housing-related sectors. However, any delay in rate cuts might slow momentum.

What are the biggest risks for UK investors in 2025?

The key risks include renewed inflation, policy unpredictability, global financial stress (especially from U.S. markets), and overvaluation in the AI/tech space. Currency swings and energy price shocks can also impact returns.

Which UK stocks should investors watch closely this year?

Top stocks to monitor include BP, Barclays, GlaxoSmithKline (GSK), National Grid, and Nscale Technologies (set for IPO in 2026). These firms represent a mix of value, growth, and defensive potential in key UK sectors.

If you want to point out something then you gladly can via our contact us page or just comment below